Bo Shrek

Super Freak

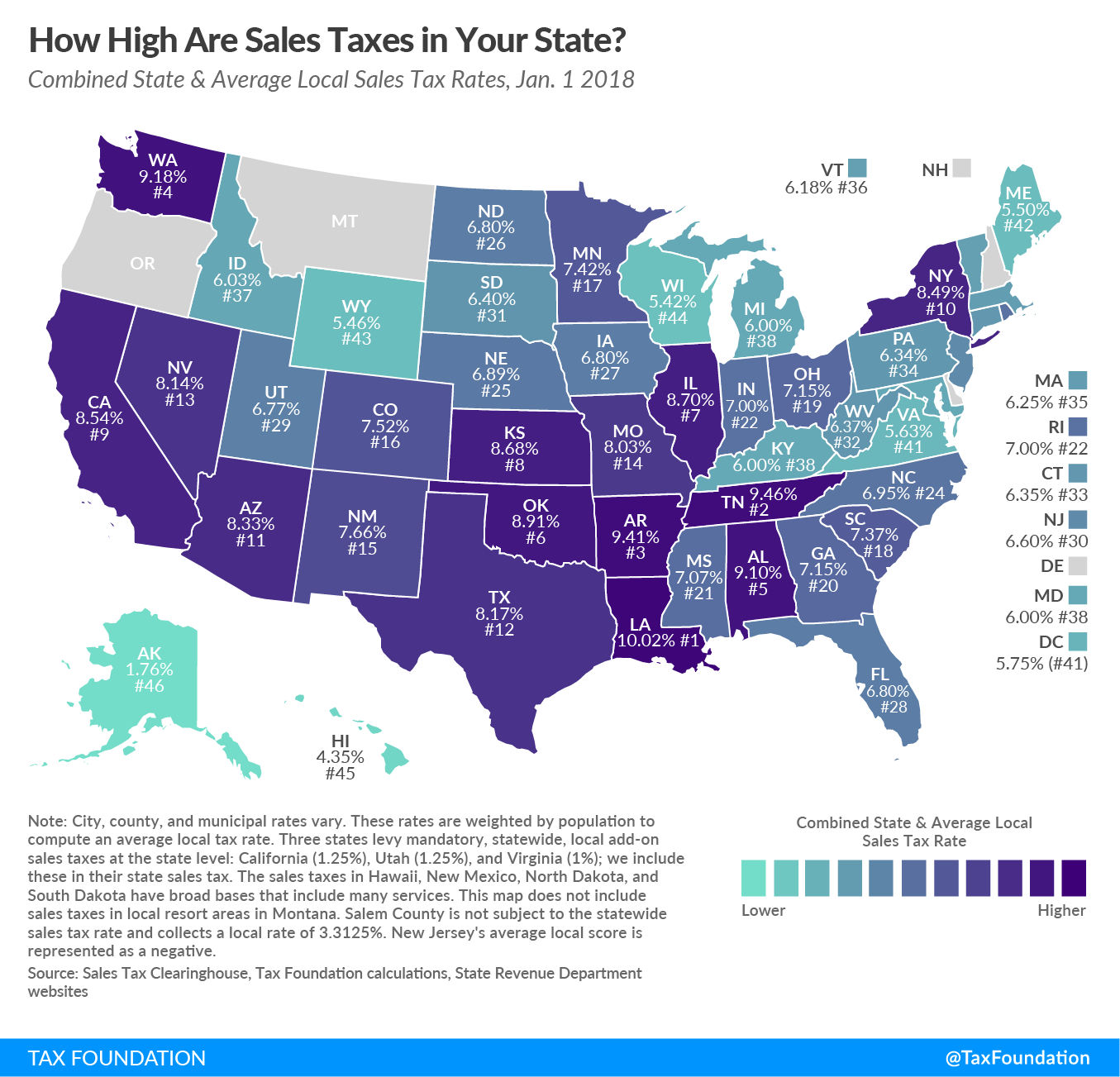

For certain states, yes starting September 30th. Even my pre-orders will be charged sales tax when they get shipped according to the email i received. The email stated that they anticipate that most states will have a sales tax law in place by the end of the year. My state, Washington, apparently already has one. So, the big question for me is: will all of our online retailers for 1/6 scale figures fall under this new set of tax laws? I asked sideshow yesterday in a chat and they did not have an answer for me.

Boooo!! So what’s the sales tax in Washington? Even more reason to stop collecting